Smooth Transactions: The Impact of In-App Wallets on Ride-Hailing Services

In the rapidly evolving world of ride-hailing services, the importance of seamless and secure transactions cannot be overstated. With the advent of digital technology, in-app wallets have emerged as a game-changer, offering a plethora of benefits that extend beyond mere convenience. As a leader in SaaS-based taxi app development, we understand the transformative impact these digital wallets have on the operational dynamics and customer satisfaction of ride-hailing businesses. This blog explores how integrating in-app wallets into your service can streamline payments, enhance security, foster customer loyalty, and ultimately, drive your business forward in a competitive market. Join us as we delve into the myriad ways in which in-app wallets are reshaping the landscape of ride-hailing services, making every transaction smooth and every ride experience better.

In the evolving world of ride-hailing services, seamless and secure transactions are crucial. Digital in-app wallets offer numerous benefits, transforming operational dynamics and enhancing customer satisfaction. This blog explores how integrating in-app wallets can streamline payments, improve security, foster customer loyalty, and drive business growth. Key advantages include a seamless payment experience, enhanced security, streamlined operations, and data-driven insights for better decision-making. By adopting in-app wallets, ride-hailing businesses can gain a competitive edge and significantly improve user engagement and loyalty.

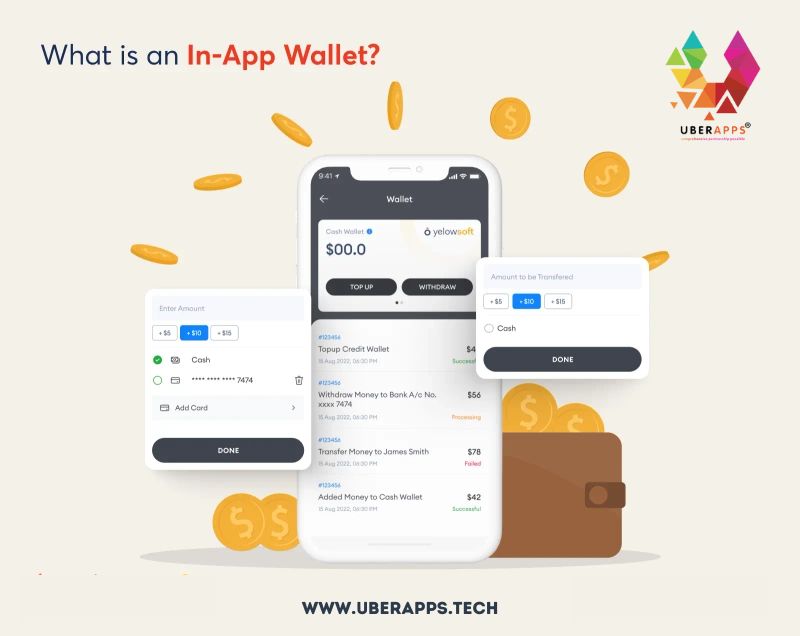

What is an App wallet?

An in-app wallet is a digital feature embedded within mobile applications that allows users to store and manage their money electronically. This virtual wallet enables users to securely link their payment methods, such as credit cards, debit cards, or bank accounts, facilitating swift transactions directly through the app. It enhances the convenience of making purchases or transferring funds without the need to re-enter payment details for each transaction. In-app wallets also prioritize security, often incorporating advanced technologies like encryption and biometric verification to protect users' financial data.

Additionally, they can offer added functionalities such as loyalty rewards, cashback programs, and financial tracking tools, which help users monitor their spending and gain more value from their transactions. This integration of payment processing and financial management makes in-app wallets a valuable tool for enhancing user experience and engagement within various digital platforms.

Impact of In-App Wallets on Ride-Hailing Services

Enhanced Customer Experience

The foremost advantage of in-app wallets is the seamless payment experience they provide. Riders can preload funds into their wallet, which can then be automatically deducted at the end of each trip. This eliminates the need for physical cash exchanges or the multiple steps involved in using credit cards. Such frictionless transactions not only speed up the payment process but also significantly enhance the overall customer experience, leading to higher satisfaction and retention rates.

Improved Security and Trust

Security concerns are paramount in digital transactions. In-app wallets address these concerns effectively by minimizing the risk of fraud and theft. With advanced encryption and secure gateways, in-app wallets ensure that all financial data remains protected. Furthermore, the transparency and traceability of digital wallet transactions build trust among users, reassuring them that their money and personal information are safe.

Streamlined Operations and Lower Costs

For ride-hailing businesses, in-app wallets reduce the complexity of managing financial transactions. By centralizing the payment process within the app, companies can avoid the hassles associated with handling cash or reconciling credit card payments. This not only streamlines operations but also reduces costs related to payment processing fees and financial reconciliation tasks. Moreover, it simplifies the payout process to drivers by facilitating quicker and more accurate disbursements.

Increased Loyalty through Rewards and Incentives

In-app wallets open up new avenues for implementing loyalty programs and promotional campaigns. Ride-hailing services can offer cashback, discounts, or loyalty points for payments made through the digital wallet, encouraging users to use the service more frequently. Such incentives not only foster loyalty but also incentivize users to keep funds in their wallets, increasing the likelihood of repeated use.

Data-Driven Insights for Better Decision Making

The integration of in-app wallets provides a wealth of data on user spending habits and preferences. This data can be leveraged to gain insights into customer behavior, peak usage times, and preferred payment methods. Armed with this information, ride-hailing companies can make informed decisions about promotional strategies, pricing adjustments, and service enhancements.

Competitive Edge in a Crowded Market

In today's competitive landscape, differentiating your service is crucial. Offering an in-app wallet can provide a significant competitive advantage. It not only enhances user convenience but also positions your brand as a forward-thinking, customer-oriented service. This is particularly compelling in markets where digital payment solutions are becoming the norm rather than the exception.

Ride-hailing apps with and without in-app wallet

Ride-hailing apps have transformed urban mobility, offering convenience and flexibility that traditional taxis often can't match. The integration of in-app wallets into these platforms further enhances their utility and efficiency. Here’s a comparison of ride-hailing apps with and without in-app wallets:

Ride-Hailing Apps with In-App Wallets

- Enhanced User Experience: Apps with in-app wallets provide a seamless payment experience. Users can preload funds and have fares automatically deducted at the end of each ride, minimizing transaction time and hassle.

- Improved Security: In-app wallets often utilize advanced security measures, such as encryption and tokenization, to protect user data and prevent fraud. This can reassure users, making them more comfortable using the service.

- Increased Customer Loyalty: The convenience of an in-app wallet can lead to higher user retention. Apps might offer rewards or cashback for using the wallet, further incentivizing repeat use.

- Streamlined Operations for Providers: From a service provider's perspective, in-app wallets simplify the financial management aspect of operations, reducing the complexities of handling cash transactions and expediting the reconciliation process.

- Data Collection and Marketing: In-app wallets allow companies to gather detailed data on customer spending habits and preferences, which can be used to tailor marketing strategies and improve service offerings.

Ride-Hailing Apps without In-App Wallets

- Dependence on External Payment Methods: Apps without their own wallets rely on external payment methods like cash, credit, or debit cards. This can increase the time spent on each transaction and sometimes introduces issues like declined transactions or payment disputes.

- Security Risks: Handling physical cash or repeatedly entering credit card information increases the risk of theft and fraud. It also places a burden on users to keep their data secure.

- Limited Marketing Opportunities: Without integrated payment systems, these apps miss out on valuable data that could be used for personalized marketing and customer retention strategies.

- Operational Complexities: Providers may face increased operational challenges, such as managing cash flows, dealing with banks, and ensuring all transactions are properly logged and reconciled.

- Lower User Engagement: Without the convenience and incentives provided by an in-app wallet, users may be less engaged and less likely to show loyalty to a particular app, especially if competing services offer more convenient payment solutions.

Conclusion

The integration of in-app wallets into ride-hailing apps is more than just a trend; it's a strategic enhancement that can drive significant improvements in customer experience, operational efficiency, and financial management. As a SaaS-based taxi app development company, we are committed to leveraging this technology to help you transform your ride-hailing business into a more profitable, efficient, and user-friendly service. Embrace the future of transactions in ride-hailing with our comprehensive digital wallet solutions, and watch your business accelerate to new heights.

Ready to launch a taxi service with our Saas Based Taxi App Development Company? Discover our UberApps Taxi App, inspired by Uber — your fastest route to owning a thriving taxi business.

FAQ's

1. Why do taxi service companies need mobile apps?

Taxi service companies require mobile apps to stay competitive in the rapidly evolving transportation market. These apps streamline the booking process, enabling customers to secure rides with ease and convenience, directly from their smartphones. They enhance user experience through features like fare estimation, real-time GPS tracking, and secure payment options, which significantly increase customer satisfaction and loyalty. By offering promotional deals and real-time updates through the app, companies can effectively engage customers and increase their market reach, ultimately driving higher revenue and business growth.

2. What is the need of a mobile app wallet in a taxi app?

Integrating a mobile app wallet into a taxi app is crucial for enhancing the efficiency and user experience of ride-hailing services. This feature streamlines the payment process, allowing users to preload funds, manage transactions easily, and pay for rides with a single tap, eliminating the need for cash exchanges or credit card swipes. It boosts user convenience significantly, reduces transaction time, and minimizes the risk of payment discrepancies.

3. Why is payment gateway integration so important in taxi apps?

Integrating payment gateways into taxi apps is crucial as it offers the full functionality of a point-of-sale system without the need for costly hardware. This setup enables drivers to efficiently collect fares using their mobile devices, while administrators gain comprehensive insights into all transactions. Such integration is essential in taxi booking apps, playing a key role in streamlining operations and enhancing the overall efficiency of the service.

4. Why is a mobile wallet safe to use in taxi applications?

Using mobile wallets in taxi applications provides a secure and convenient way to handle transactions, enhancing safety for both drivers and passengers. These wallets employ robust security measures such as encryption and tokenization, ensuring that sensitive payment information is kept secure and not directly handled or viewed by the taxi service or drivers. This significantly reduces the risk of fraud and data breaches.

Author's Bio

Vinay Jain is the Founder of UBERApps and brings over 10 years of entrepreneurial experience. His focus revolves around software & business development and customer satisfaction.